Summary

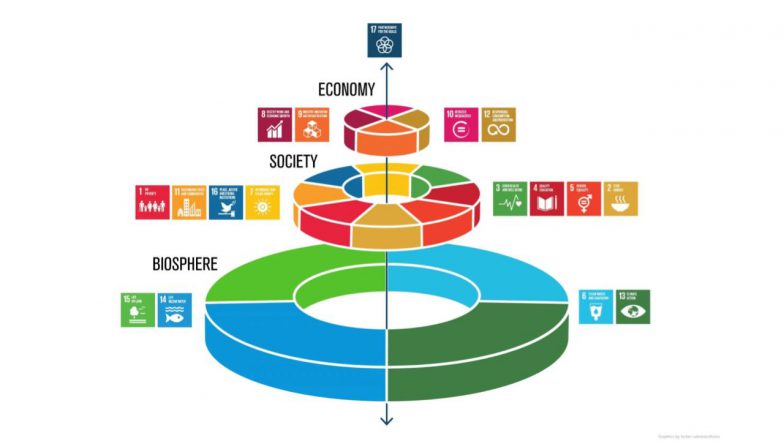

New designs for sustainability governance focus on creating institutional mechanisms to embed long-term thinking, foster integrative approaches across sectors and levels, and utilize new tools like digital twins and goal-based frameworks.

Key innovations include independent future generations commissioners, cross-functional corporate committees, and goal-based private governance that measures progress against self-defined targets, moving beyond simple regulatory compliance. These approaches emphasize complexity, participation, and adaptability to address systemic challenges and guide societies toward sustainable outcomes.

Source: Gemini AI Overview 8/26/25

News

Vinson & Elkins – June 9, 2025

Key Insights found throughout this issue include:

- Shift in Federal Priorities:

President Trump’s second term has brought significant changes, including a focus on deregulation, scrutiny of DEI initiatives, and a shift away from climate priorities set by the previous administration. - Impact on DEI and Environmental Justice:

Executive orders have dismantled affirmative action and DEI policies, leading to legal challenges and uncertainty. Environmental Justice offices and programs have been terminated, impacting federal support for EJ initiatives. - Changes in Climate and Energy Policies:

The U.S. has withdrawn from the Paris Agreement, but 24 states have committed to its goals independently. There is a pause on disbursement of funds from the IRA and Infrastructure Investment and Jobs Act, leading to legal challenges and uncertainty. - SEC and Corporate Governance Updates:

New SEC Chairman Paul Atkins has indicated a shift in priorities, including nixing CEO Pay Ratio disclosures and revisiting climate-related disclosure rules. The SEC’s new system, EDGAR Next, aims to enhance security and traceability of filings. - Board Diversity and Proxy Advisor Policies:

The Fifth Circuit vacated Nasdaq’s board diversity rule, leading to changes in proxy advisor policies and a relaxation of diversity expectations. ISS and Glass Lewis have updated their voting policies, reflecting the changing landscape.

About

Web Links

Innovations

Source: Other

Integrated governance

- The Integrated Sustainability Governance (ISG) framework embeds environmental, social, and governance (ESG) factors into all levels of an organization, from daily activities to strategic planning.

- The Sustainability Balanced Scorecard (SBSC) is a practical framework for implementing the requirements of emerging regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD), by linking sustainability with corporate strategy.

- PwC’s Sustainable Value Governance framework helps leaders manage sustainability and ESG forces—natural, regulatory, and market—to drive value and create a competitive advantage.

Polycentric governance

- Multiple centers of authority operate at various scales, from local communities to international organizations, interacting through networks of cooperation, competition, and conflict.

- Hybrid governance arrangements combine polycentric approaches with centralized coordination, balancing local innovation with the need for system-wide coherence, especially for large-scale energy and infrastructure projects.

Digital governance

- ESG technologies help companies monitor and manage their environmental footprint, social impact, and governance standards.

- AI-powered solutions are used for automated carbon accounting, optimizing supply chains to reduce emissions, and improving sustainable agricultural practices.

- Blockchain enhances the transparency and traceability of supply chains, ensuring ethical sourcing and production.

- Digital twins, virtual versions of physical products, can be used to test innovations that require fewer materials and conserve resources.

Multi-committee and stakeholder-centric governance

- Multicommittee frameworks distribute ESG responsibilities across multiple board committees, such as nominating and governance, audit, and dedicated sustainability committees. This approach acknowledges the interconnectedness of ESG issues.

- Stakeholder-centric governance shifts the focus from just shareholders to a broader range of stakeholders, including employees, customers, and communities.

Specific reporting and accountability designs

- International Sustainability Standards Board (ISSB) Standards provide a global baseline for sustainability and climate-related financial disclosures. Following ISSB standards is now recommended for global businesses.

- Mandatory sustainability reporting, such as the EU’s CSRD, requires detailed, verifiable sustainability data. This legal mandate significantly increases transparency and accountability.

- The rise of “Nature Positivity” and biodiversity reporting mandates companies to disclose their impacts and set targets related to biodiversity and nature loss.

- Enhanced due diligence directives, like the Corporate Sustainability Due Diligence Directive (CSDDD), hold corporations accountable for human rights and environmental risks across their entire supply chain.