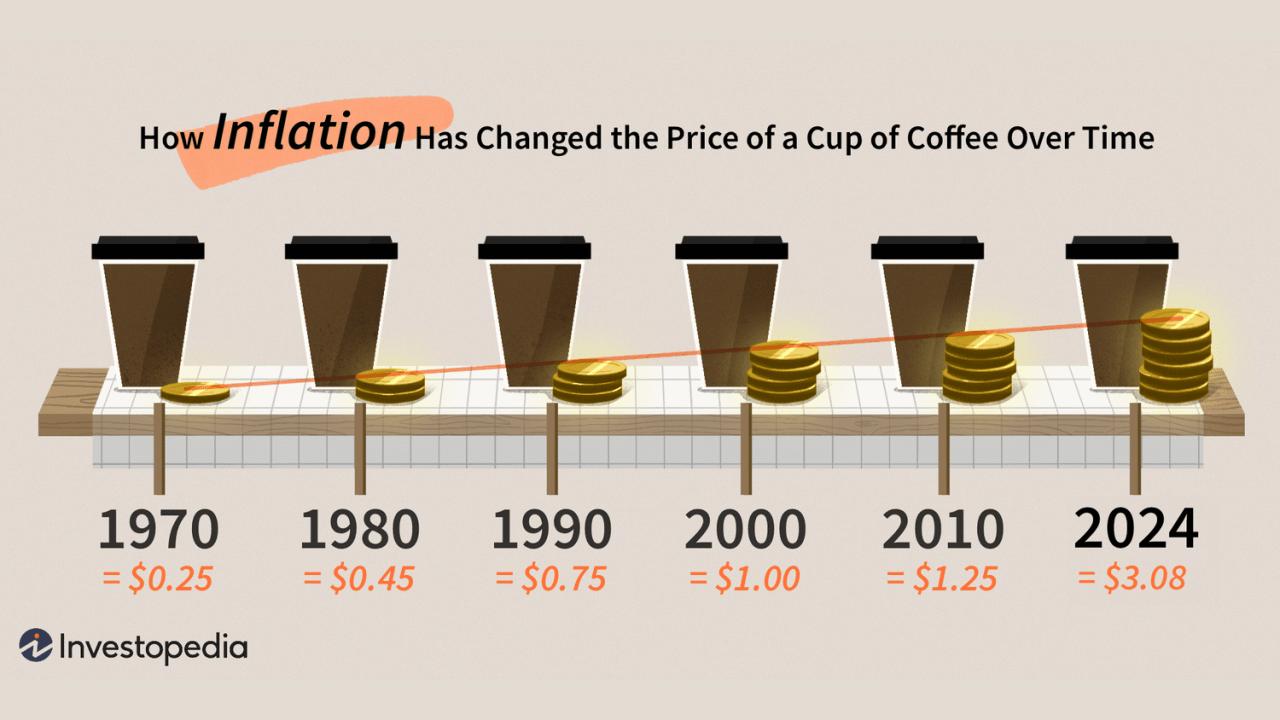

Inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. This means that over time, the same amount of money buys fewer goods and services. Inflation is a normal part of economic cycles, and a moderate, stable rate of inflation is generally considered healthy for an economy as it can encourage spending and investment, which can lead to economic growth. However, when inflation rises rapidly or becomes excessively high, it can have detrimental effects on individuals and the economy as a whole.

OnAir Post: Inflation