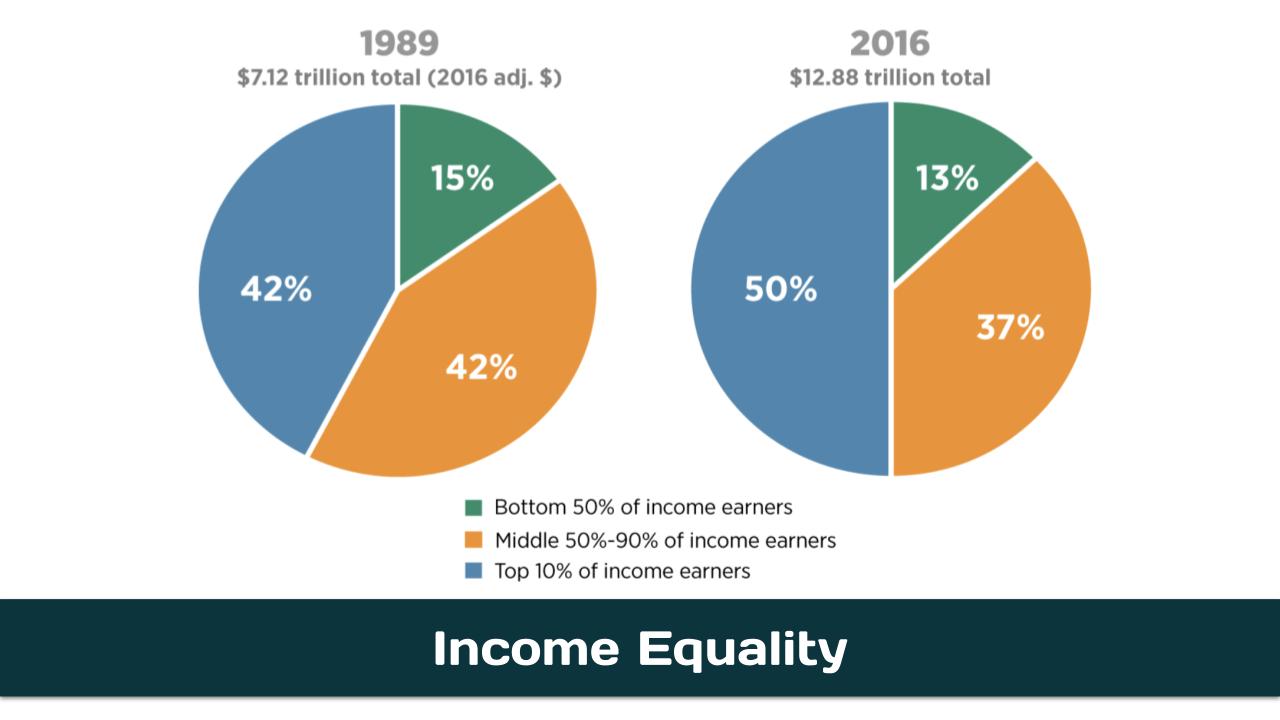

Income inequality refers to the uneven distribution of income among a population within a society. It is distinct from wealth inequality, which focuses on the distribution of assets like property, stocks, and savings. Both are important aspects of economic inequality, a broader term encompassing disparities in both income and wealth.

It’s important to note that the debate over the optimal level of income inequality is ongoing. However, the current levels in many countries, particularly the U.S., are generating significant concern due to the negative impacts on economic growth, social well-being, and democratic institutions.

OnAir Post: Income Inequality